12 LPA

20+ LPA

The CA course stands out as the supreme choice of aspiring students worldwide; numerous students and working professionals enrol for the course each year to become Chartered Accountants. The Chartered Accountancy (CA) program in India is governed by the Institute of Chartered Accountants of India (ICAI).

Chartered Accountants have numerous esteemed job prospects in India and abroad, offering attractive salary packages. As a CA, you have the flexibility to either establish your independent practice or secure positions in the financial departments of various firms and companies.

Getting ahead on your CA journey straight after completing the 12th grade helps you to establish a successful career very early. The CA program, known for its inclusivity, welcomes young enthusiasts from various academic backgrounds to delve into the world of CA and equips them with the authoritative power to become finance leaders. The qualification unfolds in three progressive levels: CA Foundation, Intermediate, and Final, with each stage featuring a series of exams complemented by hands-on practical experience that enables the candidate to hold the prestigious professional designation within 4- 5 years.

At IIC Lakshya, we transcend the role of guides in your CA journey; we become your companions in knowledge acquisition, skill development, and personal advancement. Our ultimate aim is to prosper CA aspirants toward success through valuable guidance, empowering them to flourish as accomplished professionals. With a meticulously crafted curriculum and a team of exceptional faculty members, we proudly stand as the go-to destination for aspiring finance professionals.

If CA is your aspiration, we are here to champion your dreams.

Step into the realm of CA! Beyond being a mere certification, it's a distinguished qualification with global recognition, offering you a wealth of skills and knowledge. Brace yourself for an enriching journey that paves the way for your success!

CA Foundation is the gateway to the Chartered Accountancy course, functioning as its entrance examination. It's an inclusive opportunity, open to students from any academic background or stream. Notably, graduates and postgraduates receive an exemption from the CA Foundation and are granted direct eligibility for CA Intermediate. The CA Foundation Course spans around six months. To be eligible to attempt the exam, you should have passed your class 12th exams from a recognised board, and Commerce students should secure 50%, while Science students need at least 55% in their exams.

This paper will enhance your understanding of fundamental accounting concepts and principles. It aims to empower you to construct financial statements efficiently, address basic accounting principles, and align them with challenges in accounting.

The key objective of this paper is to help students understand crucial aspects of specific business laws and equip them to tackle real-world issues related to these laws.

The Negotiable Instruments Act, 1881

This part is designed to assist you in developing an understanding of the essential mathematical and statistical tools that should be applied in business, finance, and different economic scenarios. It also aims to improve your logical reasoning skills and use them to solve problems that may arise in your professional journey. The syllabus is divided into three major areas.

Business Mathematics:

Logical Reasoning:

Statistics:

The primary goal is to aid your understanding of essential concepts and theories in Business Economics, enabling you to apply them to solve practical problems in everyday scenarios.

If you think CA, Enrol with Lakshya!

Choose CA and Step into a world of possibilities.

Opting for the CA course opens doors to a prestigious professional career. Qualified Chartered Accountants can work in higher positions upon completing the course and even have the chance to work as an external auditor and embrace the ultimate signing authority.

Experience substantial financial rewards as a Chartered Accountant, with the potential to earn competitive salaries ranging from 12 to 15 LPA in 4-5 years. The CA qualification is critical to unlocking senior roles in esteemed firms, offering a pathway to a successful and fulfilling career journey.

Embark on your CA journey with the flexibility to learn anywhere, anytime. The CA course accommodates your schedule with various study options, including online classes, offline classes, and hybrid modes. This adaptability ensures you can seamlessly balance your work commitments while pursuing your CA qualification.

12 LPA

20+ LPA

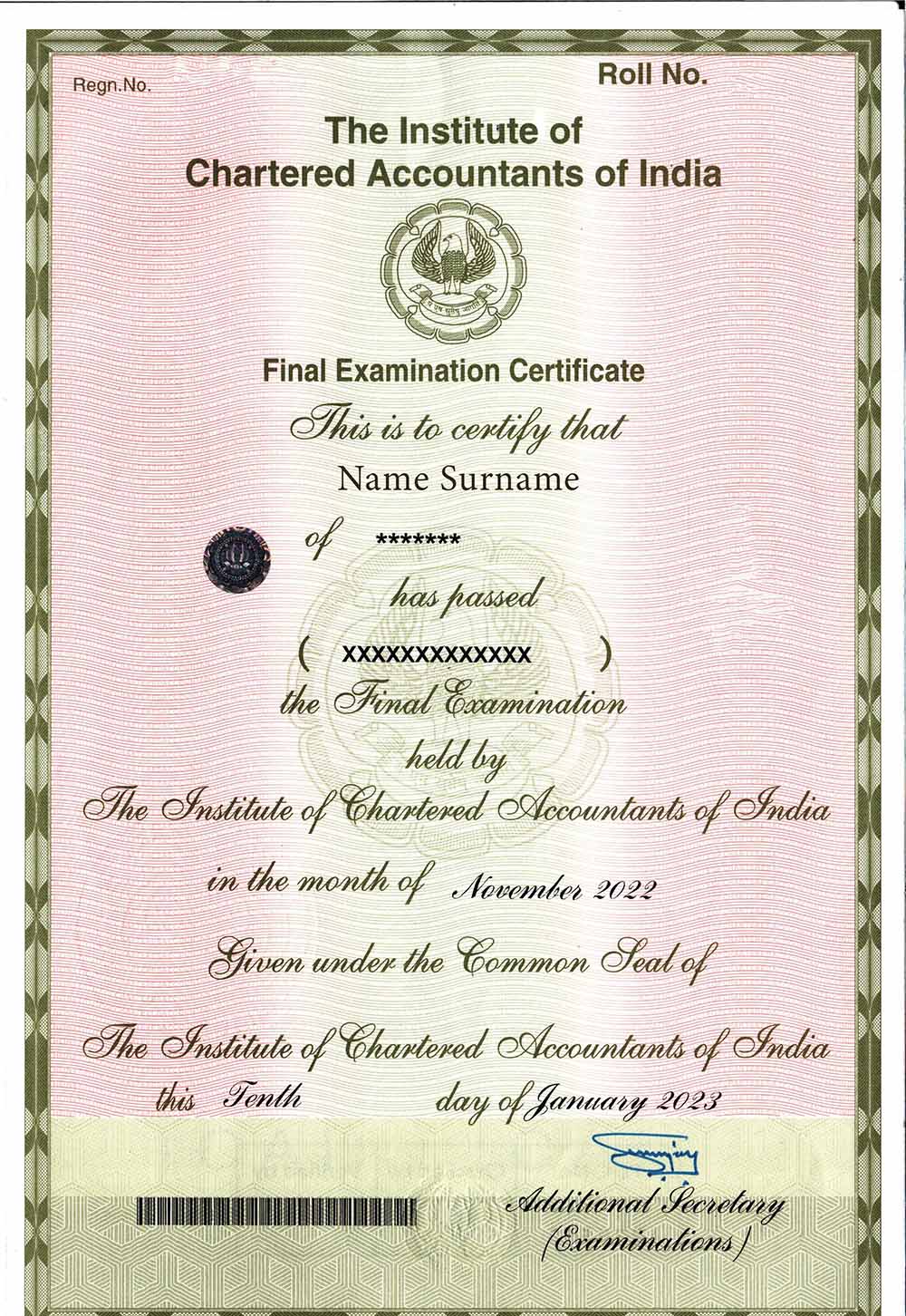

Chartered Accountancy certification is one of the most prestigious certifications that enables an aspirant to lead a highly esteemed professional career.

Earn Your Certificate

Learning Modes

Offline Classes

Experience the lively classroom setting in person. Connect with instructors and classmates personally, engage in face-to-face interactions, and get instant feedback for an enriching learning experience.

Online Live Classes

Discover the wisdom of our skilled educators, no matter where you find yourself physically. Immerse yourself in live discussions with teachers and fellow learners, creating a vibrant, teamwork-infused learning journey.

Hybrid Classes

Combine the convenience of online learning with the personalised touch of live sessions. Dive into the core concepts with recorded lectures and enhance your skills through engaging practice sessions guided by experienced instructors.

What is a CA Course?

CA, the Chartered Accountancy course provided by the ICAI, is one of the highly prestigious professional courses that enables aspirants to earn a reputed career.

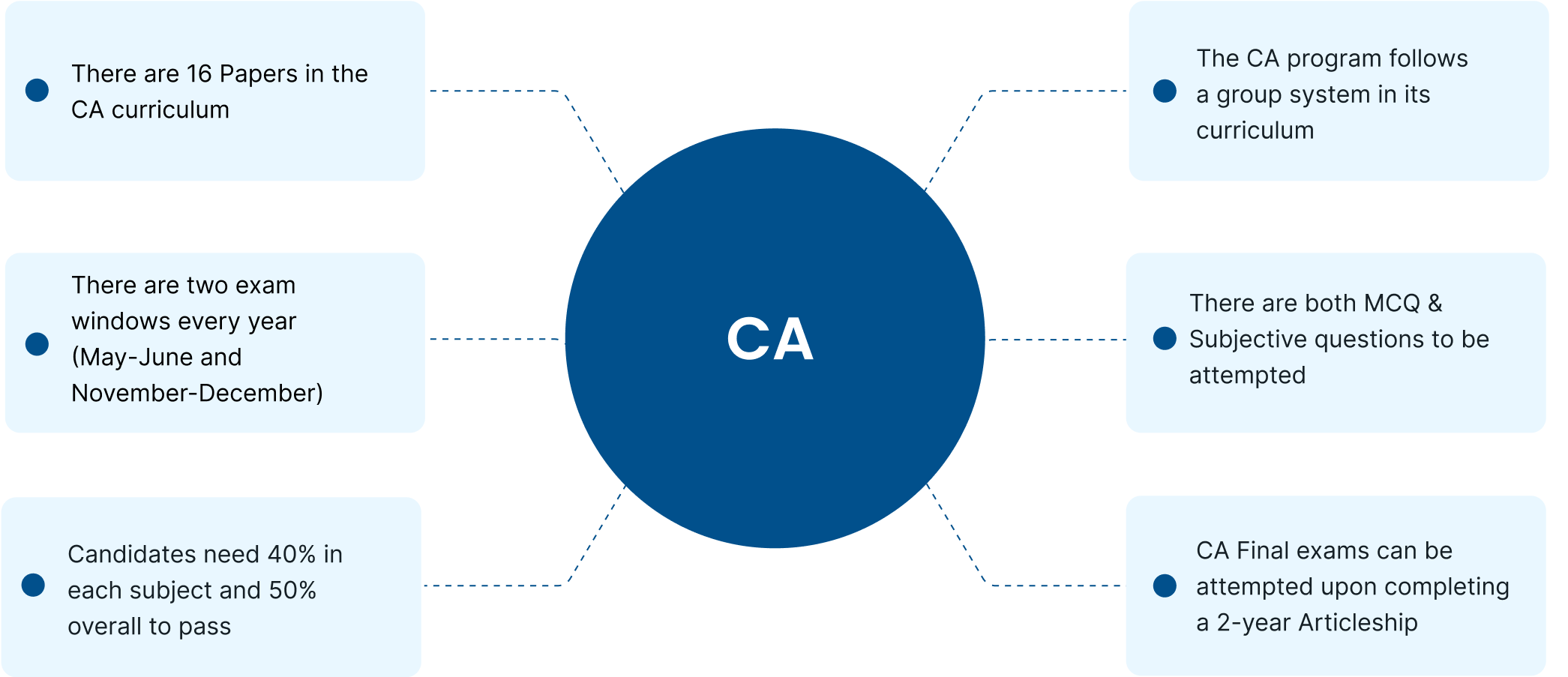

How many Papers are there in the CA course?

There are 16 papers in the CA curriculum scattered over three-course levels.

What is ICAI?

ICAI, The Institute of Chartered Accountants of India, is the statutory body providing Chartered Accountancy courses. The board manages the syllabus and exams and governs the course.

When Can I Attempt the CA exams?

The CA exams can be attempted twice yearly; the exam windows are in May and November.

What is the eligibility to learn CA?

Class XII from any recognised board is the minimum educational qualification required to get admission to a CA course.

How many levels are there in the CA course?

There are three levels in the CA course. CA Foundation CA Intermediate CA Final

What is the duration of the CA course?

A student needs about 4-5 years to qualify as a Chartered Accountant.

What is Articleship in the CA course?

It is a mandatory Two-year practical training program for aspiring CA candidates. This training program aims to provide candidates with hands-on experience in accounting, taxation, finance, and auditing.

What is the eligibility for an Articleship?

Once candidates have cleared the CA Intermediate level exam are eligible for the Articleship. Candidates also need to complete a mandatory 15-day orientation program conducted by ICAI.

What is the educational qualification required for the CA Intermediate course?

A student who has completed the CA Foundation course can attempt CA Intermediate level exams. Apart from that, any student with a graduation certificate can also attempt the intermediate level through the direct-entry scheme.

What are the requirements for the CA Final course?

Any student ready to attempt the CA Final exams must have successfully cleared both groups in the CA Intermediate level and should have completed an Articleship training of 2 years.

What is the group system in the CA course?

The CA course's group system refers to categorising subjects into groups, and candidates need to clear all subjects within a group to progress in their CA studies.

What is the average salary of a CA in India?

Chartered Accountants (CAs) earn salaries ranging from Rs. 12 to 15 lakhs annually. Those working overseas can make even higher, with some reaching up to 50 lakhs annually.

Which group should be attempted first in the CA curriculum?

The choice of group entirely pertains to the student's decision; the candidate can attempt any group at the respective levels.

Can students from non-Commerce streams learn CA?

Students from non-commerce streams can also choose CA; they can start with the foundation course after the 12th or select direct entry after graduation.

What is the pass mark for the CA course?

The passing score for CA exams is at least 40% in individual subjects and 50% in aggregate.

What kinds of jobs can one get after finishing the CA programme?

After being qualified as a Chartered Accountant, you can get jobs as an auditor, finance Manager, Accounts head, etc, and you have the power to practice as a Chartered Accountant, thereby gaining the esteemed signing authority.

What is the admission procedure to enrol for a CA Foundation course?

The first level in the CA curriculum is the CA Foundation exams. To attempt the same, a candidate must register with ICAI on or before the date announced by ICAI.

What is direct- entry in CA?

Graduates benefit from direct entry to the CA Intermediate level, thereby getting an exemption of 4 papers in the CA syllabus.

Does the CA program have a registration fee?

Yes, a registration fee is required for each level of the CA program. The official website of the ICAI has a fee structure.

Can I work towards a B.Com. And the CA program at the same time?

You can strengthen your academic and professional credentials by simultaneously doing the CA program and a degree like a B.Com.

Who can pursue CA?

CA can be pursued by any candidate who has completed 12th grade, irrespective of their professional background or age.

When is the application time for the CA Foundation course?

CA Foundation course can be completed within six months.

When can a student start preparing for CA?

Students can start as early as their 10th grade for CA Foundation exams through weekend classes or online sessions. Upon completing the 12th grade, they can attempt the CA Foundation exams.

What is the admission fee for a CA course?

To attempt the CA Foundation exams, the student must register with ICAI and pay relevant fees. Apart from that, different institutions charge coaching fees to provide you with learning support to complete the course.

Are there any requirements to be eligible for the CA program?

The candidate applying for the CA Foundation exam should have successfully passed 12th grade, and the candidate applying for the CA Inter level must have graduated or have cleared four papers in the CA Foundation exam.

When are the exams conducted for the CA course?

The candidate has to clear 16 papers to qualify as a Chartered Accountant; there are two exam windows every year: May, June, November, and December.

How many papers are there in the CA Foundation course?

There are four papers in the CA Foundation course.

How many papers are there at the CA Inter level?

There are six papers in the CA Intermediate syllabus.

Group 1

Group 2

Explain the group system in CA?

The students need to clear all papers in each group to qualify to the next level, failing to clear any one paper in a group will lead to repeating the entire group in the next attempt.

How many Papers are there in the CA Final?

There are six Papers in the CA Final level.

Group1

Group 2

What was the recently made change in CA Syllabus?

The count of 8 papers in the CA Inter level was deducted into six papers, and in the CA final level, the count of 8 papers was cut down into six. The duration of articleship has also been shortened to 2 years.

Are Chartered Accountancy Exams Computer Based?

No Chartered Accountancy exams are paper-based.

What is the duration of CA exams?

The duration to complete each paper in CA exams is 3 hours.

Who conducts CA Exams?

ICAI conducts the CA exams twice every year.

What is the format of the CA exams?

CA Exams are pen-paper-based; each paper carries 100 marks, the pass mark for each paper is 40%, and the candidate needs 50% for each group.

Does IIC Lakshya offer online courses for CA?

Yes, IIC Lakshya provides online CA courses, giving students flexibility in accessing high-quality teaching.

Does IIC Lakshya keep updated with the latest CA syllabus?

The faculty at IIC Lakshya keeps up with syllabus modifications; we also regularly update study guides and coaching techniques to correspond with the most recent CA curriculum.

Does IIC Lakshya conduct mock exams for CA students?

To help students prepare, IIC Lakshya hosts mock exams that regularly mirror actual exams.

Does IIC Lakshya provide other programs besides regular classes to help boost the student's employability?

Yes, IIC Lakshya hosts skill development programs and workshops, which provide students with an avenue to obtain practical skills aligned with industry demands.

Where can I study CA?

You can choose to study CA at IIC Lakshya; there are eleven branches across Kerala and outside Kerala in Bangalore, Mumbai, Delhi, and Kolkata. Lakshya has expanded their legacy to the UAE as well.

How does IIC Lakshya differ from other CA institutes?

Lakshya provides personalised mentoring, doubt-clearing advantage, and expert-led training for aspiring Chartered Accountants.

How can I contact IIC Lakshya faculty members with questions and clarifications?

IIC Lakshya encourages candid dialogue. Through approved routes, students can communicate with instructors, guaranteeing their questions are answered quickly.

Can I attend classes at IIC Lakshya virtually?

Yes, IIC Lakshya offers online classes. This gives students the freedom to attend from a distance and guarantees that they can get high-quality coaching. You can contact our career experts, who can assist you with that.

Do CA students at IIC Lakshya have access to scholarships?

IIC Lakshya recognises and rewards academic success by providing merit-based scholarships to worthy CA students.

Can I switch to IIC Lakshya from another CA coaching institute?

Students can transfer to IIC Lakshya, and our team helps ensure a smooth transition by reviewing prior coursework and assisting with a smooth integration.

How does IIC Lakshya differ from other CA coaches?

IIC Lakshya is the number 1 institute providing comprehensive coaching to CA aspirants. Lakshya has eminent industry expert faculties, a full-fledged learning environment, and one-to-one mentorship assistance, bringing in high yearly results.

Does IIC Lakshya help CA students with placement/articleship?

Yes, IIC Lakshya helps students with extensive support regarding placements or Articleship. IIC Lakshya has a placement cell to provide the students with the necessary assistance.

Do CA students at IIC Lakshya have access to scholarships?

Students can avail themselves of scholarship opportunities from IIC Lakshya by taking a scholarship exam.

How does IIC Lakshya help students prepare for real-world situations and CA interviews?

IIC Lakshya provides students with a real-time and practical learning opportunity by conducting seminars, skill development training, and sessions from experts in the field to guide them toward their professional journey.